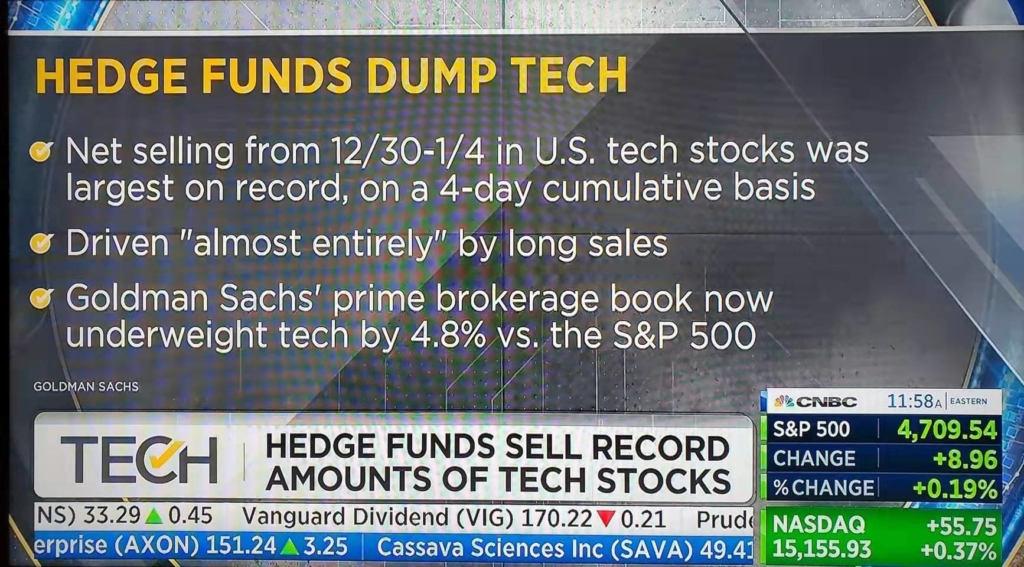

This could be the theme for 2022. The rotation from growth to value… from tech to industrials… As a tech guy, I really don’t want to buy into it but… can’t fight the tape.

They say that this year will be a bumpy one for US equity investing. Smart money people are saying that major US indices will not match the 20+% returns of the last couple of years. However, no recession is predicted by anyone and unless we have a black swan moment, at least 10% to 12% returns are being forecast.

So, where to invest for 2022? Let’s look at some themes. First, let’s take a look at the themes that have already been played:

COVID – Ever since the large correction 2 years ago because of COVID, US equity markets have basically been on a strong upward trend. There were many reasons for this such as government stimulus but these factors are almost out of steam and thus, COVID as a stock market play is pretty much dead.

Opening Up – The start of 2021 had huge expectations of boom economies not just in the US but around the world. Hindsight being 20/20, we know that it didn’t happen to the level of what was expected. There are still areas that haven’t open up all that much such as tourism but most others have had strong rallies as shown in the S&P 500.

Holiday Rally – We had strong upward movements in October and the Santa Claus rally in December but now these have passed.

So, what are the possible themes for 2022? We need to look pass the momentums of 2021 and see what will be different. Below is a list of potentials:

January Effect – This obviously is a short-term play but equities are still a dominant investment vehicle for institutionals and the US market is dominated by the institutions. They have cash and are re-balancing their portfolio during this month.

Inflation – Bond rates are going up which is scaring growth. However, we are still at historically very low levels when it comes to interest rates. There is precedence that technology stocks can thrive in a higher interest rate environment. Just look at the dotcom years as an example. It will take time for investors to accustom themselves back to the old-normal since the low interest rate environment of the new-normal has been going on for quite a while.

Greater China Region – Regulatory uncertainty has always been a risk factor when investing in China. 2021 just saw what happens to equities when these risks are realized. However, China’s high-level goal is to have a harmonize and prosperous society. They will not kill their own industries but in fact they are dependent on them to do well. Investing in Chinese companies through the US might be a risky bet since they could pull out of the US markets but these stocks still need a home and more are thinking about Hong Kong. The Heng Seng Index has significantly underperformed in 2021. Look for 2022 for it to catch up.

Laggards – The traditional industries that didn’t fully participate in the 2021 opening up run-up could see them playing catch up this year. There is a lot of money in tech. Apple at US $3 trillion is just one example. If this money is looking for a new home, the DOW and S&P indices will definitely have a strong year.

EdTech – Educational institutions have been stubbornly slow in adopting tech but COVID has forced their hand. These institutions are finding out that they need to be nimble in how they provide their services because governments can mandate, very quickly, social distancing measures. Education is such a massive, human capital-intensive set of manual processes. They are also experiencing labor crunches where teachers are quitting or thinking about quitting in significant numbers. All these pain points have already been solved by tech in other industries. Education is an easy sell if you can get administrators to buy-in. They will be buying in large numbers this year.

So, how can you know with some certainty what will happen in 2022? US equity investing is somewhat rational since it is still dominated by institutions. To understand these rationalities and to apply them correctly takes lots of years of investment experiences and knowledge.

And now I chime in… 😊 I have decades of experience investing in the US markets and have a strong understanding of industry cycles and US macroeconomic factors. I also have an MBA from the Chinese University of Hong Kong which is known as a banking school. A lot of my classmates and alumni are in capital markets. If you wanna know more… Let’s Talk!

Oh… P.S… of course, this is not investment advice but just my 2-cents based on my background.